BERAWAL DARI SEBUAH

TRADISI YANG KOKOH

Bermula sebagai perusahaan ekspor/impor di tahun 1952 yang didirikan oleh Bapak Sjukur Pudjiadi, Grup Jayakarta kini telah berevolusi menjadi salah satu pengembang dan pemain utama di industri perhotelan yang disegani di Indonesia.

359,642 m2

Luas lahan yang dibangun

70,552 m2

Luas lahan komersial

3512

Kamar hotel yang dikelola

699

Jumlah unit apartemen eksklusif

TENTANG PENDIRI

SJUKUR PUDJIADI

Walaupun terlahir dari keluarga yang mapan dan terpandang di Indramayu, Poey Seng Kiang (yang kemudian lebih dikenal sebagai Bapak Sjukur Pudjianto), dididik dengan kedisiplinan dan kesederhanaan. Selayaknya anak pada umumnya pada jaman itu, sesekali dia mendapatkan pukulan rotan dari ayahnya karena kedapatan membolos sekolah. Namun terlepas dari kenakalan-kenakalan kecilnya, sedari belasan tahun naluri bisnisnya sudah nampak jelas. Poey Seng Kiang remaja menyewa truk Belanda untuk membeli barang-barang kebutuhan sehari-hari ke Cirebon. Hasilnya sangat memuaskan dan membuat Poey Seng Kiang kelak menjadi lebih bersemangat untuk berbisnis. Keahliannya dalam berbisnis semakin terlihat ketika beliau mulai mendirikan perusahaan ekspor/impor di tahun 1952. Namun Bapak Sjukur Pujiadi tidak mudah berpuas diri. Ketika Gubernur Jakarta saat itu, Bang Ali Sadikin, membuka tender untuk membangun hotel elit di kawasan Glodok, beliau tidak menyianyiakannya. Dengan komitmen dan kemampuannya untuk belajar secara otodidak, Hotel Jayakarta didirikan di tahun 1978 sebagai hotel pertama tertinggi di Jakarta yang memiliki 21 lantai. Nalurinya terbukti sangat tepat. Perusahaannya semakin berkembang dan merambah pada properti lain, termasuk apartemen, residensial, dan komersial dan secara konsisten membukukan pencapaian-pencapaian yang membanggakan. Sosoknya yang karismatik tidak hanya membawa pengaruh baik bagi keluarga, namun juga karyawan. Nilai-nilai kekeluargaan dan kebersamaan yang selalu dijunjungnya, juga diadopsi dengan baik oleh perusahaan, menjadikan Grup Jayakarta sebagai satu keluarga besar yang kompak. Filosofi kerjanya yang mengutamakan prinsip kehati-hatian dalam bertindak diwariskannya ke dalam perusahaan. Grup Jayakarta adalah salah satu pionir di bidang property yang sampai saat ini terbukti dapat bertahan melewati tantangan jaman yang berbeda, dan semakin kuat bahkan setelah melewati beberapa dekade.

“ VISION + ACTION = PROSPEROUS VISION NO VISION + ACTION = NIGHTMARE

SJUKUR PUDJIADI

Sebagai pemain veteran yang telah berkecimpung sejak tahun 1970, Bapak Sjukur Pudjiadi menunjukkan insting bisnis yang kuat dalam membesut berbagai proyek pionir yang terbukti menjadi landmark di lokasi-lokasi strategis, bahkan sampai saat ini. Dengan menggabungkan intuisi tajam dengan kalkulasi matang, Grup Jayakarta menunjukkan komitmen tanpa henti dalam menghadirkan produk unggulan yang inovatif di tengah-tengah persaingan industri properti yang ketat. Menjadi yang pertama dan terbaik sudah menjadi misi Bapak Sjukur Pudjiadi sedari awal mendirikan perusahaan ini.

Hotel tertinggi pertama di Jakarta dengan 21 lantai(Hotel Jayakarta)

Bangunan residensial dan komersial milik swasta pertama di Jakarta(Jayakarta Plaza)

Apartemen tertinggi pertama di Jakarta Selatan(Senopati Apartment)

Resort bintang lima pertama dan terbesar di Anyer(Marbella)

Kompleks perumahan terbesar di Serang sebesar 200 ha(Highland Park)

Tidak hanya itu, beliau juga banyak mencetuskan konsep baru di dunia properti, yang kemudian diikuti oleh perusahaan properti lainnya. Salah satunya adalah konsep rumah toko (ruko) yang revolusioner pada saat itu dan membawa konsep mix-use property di Indonesia. Filosofi kepemimpinan beliau diwariskan kepada keluarga dan mengakar pada perusahaan, membuat Grup Jayakarta sebagai perusahaan yang kokoh berdiri dari masa ke masa. Standar perusahaan kami yang tinggi telah menghasilkan berbagai kompleks apartemen, perumahan, area komersial, apartemen, serta hotel dan resort yang mendapatkan tempat khusus di hati pelanggan dan pembeli. Dengan desain elegan dan klasik, perencanaan yang matang, material pilihan, detil yang halus, dan finishing yang memukau, pencapaian Grup Jayakarta telah terbukti dengan diterimanya berbagai penghargaan bergengsi.

Awards

Affiliations

Visi

To Bring the Jayakarta Group to be one of the Indonesian business group with global scale that would grow continuosly to provide value to the Stakeholder with main pillars in the Property, Hospitality and Industrial Sectors.

Misi

Prioritizing positive attitude and performance to generate profitable income

Be the best in the business sector

Grow much further by creating innovation towards the market

Respect and implement the Company core value

Responsible towards society

KISAH SUKSES

JAYAKARTA GROUP

DARI MASA KE MASA

1952

Mendirikan NV Nusantara1977

Mendirikan Hotel Jayakarta sebagai hotel tertinggi pertama1978

Jayakarta Plaza didirikan sebagai bangunan dengan konsep mix-use pertama (residensial, kios, food court dan supermarket)1981

Hotel Jayakarta Seminyak, Bali didirikan sebagai hotel berbintang pertama di area tersebut1987

Senopati Apartment diresmikan sebagai apartemen tertinggi di Jakarta Selatan1990

Pudjiadi and Sons Tbk mulai go public1993

Kelapa Gading Tower Condominium didirikan sebagai apartemen pertama di kawasan Kelapa Gading1994

Marbella Anyer didirikan sebagai hotel bintang lima terbesar dan pertama di daerah Anyer1994

PT Pudjiadi Prestige go public1997

Mendirikan Highland Park sebagai kompleks residensial terbesar di Serang2005

Ekspansi pertama di luar negeri dengan mendirikan hotel di kota Fort Worth, TexasDan masih berlanjut

Pengembang Properti Terpercaya Anda

Untuk meningkatkan fokus dalam menyikapi kebutuhan pasar yang berbeda-beda, Grup Jayakarta membentuk tiga anak perusahaan : Pudjiadi Prestige Group, The Jayakarta Hotels and Resorts, dan Marbella Hotel, Convention and Spa. Setelah lima dekade, Grup Jayakarta semakin mengukuhkan dirinya sebagai pemain industri properti terdepan dengan cakupan usaha yang sangat luas : pariwisata, pengembangan real estat, kontraktor umum, kawasan industri, dan layanan finansial. Dengan tradisi dan etos kerja yang selalu mengutamakan kepuasan pelanggan, The Jayakarta Group semakin kokoh berdiri dan dipercaya oleh masyakarat. Tidak lekang oleh waktu, komitmen kami selalu sama sejak awal berdiri sampai sekarang. Produk dan layanan berkualitas terbaik bagi Anda.

Pudjiadi Prestige is one of Indonesia’s first real estate developers.

After its founding in 1980, the company first found success through developing the first privately-developed commercial building in the prestigious Kota area - Jayakarta Plaza Retail & Apartment (1982). Next, the company pioneered Senopati Executive Apartment (now Senopati Apartment by Pudjiadi Prestige) in 1987. It was not only the tallest high-rise apartment in South Jakarta at the time, but also unique for being built to rent instead of sell.

With dozens of subsequent projects now under 40+ year track record, Pudjiadi Prestige has carried a legacy of pioneering the property landscape in Indonesia and will continue to expand its unique footprint throughout Indonesia’s burgeoning property sector.

The Jayakarta Hotels & Resorts is a well-respected establishment classified as a 4 Star middle-up size hotel management company. The group has managed 7 hotels, 2 boutique suites and 1 residential condominium strategically located in various business and resort areas all around Indonesia.

The Jayakarta Suite Komodo Flores, Diving, Beach Resort & Spa is the latest development from the group and is also the first and only five star hotel resort in Komodo Flores. In total, The Jayakarta Hotels & Resorts has facilitated 1,451 rooms, 160 cottages, and 36 boutiques under operation in addition to 300 condominium of affiliated hotels around Indonesia.

Marbella Place Anyer Hotels, Resorts and Residences was founded by Mr. Kosmian Pudjiadi in early 1994 with its first Marbella development in Anyer, Banten Province. Marbella Place Anyer was developed as a mixed-use facility comprising of a 5 Star Hotel and private owned condominiums, containing 580 rooms, suites and apartments set on 10 hectare of beachfront property.

Since then, the company has grown enormously with the developments of Marbella Kemang Residence, Marbella Suites Bandung, and Cattleya Suite Condotel by Marbella in Bali.

Vision and Mission

Vision

To Bring the Jayakarta Group to be one of the Indonesian business group with global scale that would grow continuosly to provide value to the Stakeholder with main pillars in the Property, Hospitality and Industrial Sectors.

Mission

- Prioritizing positive attitude and performance to generate profitable income

- Be the best in the business sector

- Grow much further by creating innovation towards the market

- Respect and implement the Company core value

- Responsible towards society

Our Value

In run the business, the Company continues to hold fast to the philosophy and values of the main companies are:

- Customer Satisfaction and Trust are the main objectives of the Company

- Achieving optimal benefits with regard to social responsibility

- Managing the company in a professional manner based on corporate ethics, honesty and a high level of proficiency.

The company will continue to make innovations in the property industry but still focus on its core business and is supported by the commitment, expertise and experience so that the company will remain as one of the property and real estate firm and trustworthy.

Board of Commissioners

Born in Jakarta on August 18, 1962, he obtained his MBA degree from Loyola Marymount University, Los Angeles in 1985, and started his career in the Company as the Assistant of President Director on 1985. He then promoted as the President Director of the Company from 1996 until 2007. In 2007, he was assigned as the President Commissioner of the Company since 2007 until now. Aside from managing the Company, he is also active in organization such as REI, PHRI and Kadin Indonesia.

Appointed as an Independent Commissioner in 2014 pursuant to Deed No 24 dated May 23rd, 2014. Until now, he serves as the Deputy Director of PT. Megatech Indotama, Jakarta.

Obtained his MBA degree from Northrop University, Los Angeles, has served in several company such as Kanematsu Goshom USA Incorporated, Los Angeles, California as the Assistant to Manager in Chemical Department from 1989 until 1990, Director at PT. Safindo Mediadana from 1991 until 1993 and Marketing Director in PT. Futan Trading Co, Ltd Jakarta from 1994 until 2007.

Board of Directors

Born in Jakarta on August 18, 1962, he obtained his MBA degree in Finance from Loyola Marymount University, Los Angeles in 1985, started his career with the Company in 1986 as the Assistant to the President Director. He, then, posted in Dallas, Texas to develop group business in USA.

In 2005, he was back to Indonesia as a Vice President Director of the Company and became the President Director in 2007 until now.

Earned his degree in Accounting from the Economic Faculty of Gajah Mada University, Jogyakarta, started his career with the Company as a Chief Accounting in 1988.

In 1996, promoted as Deputy Director and served until 2000. Aside from being a Director at the Company, he also serves as a Director in the subsidiaries company as follows PT. Pudjipapan Kreasindo, PT. Kota Serang Baru Permai and PT. Graha Puji Propertindo which is now developing the new apartment project in Cikarang area

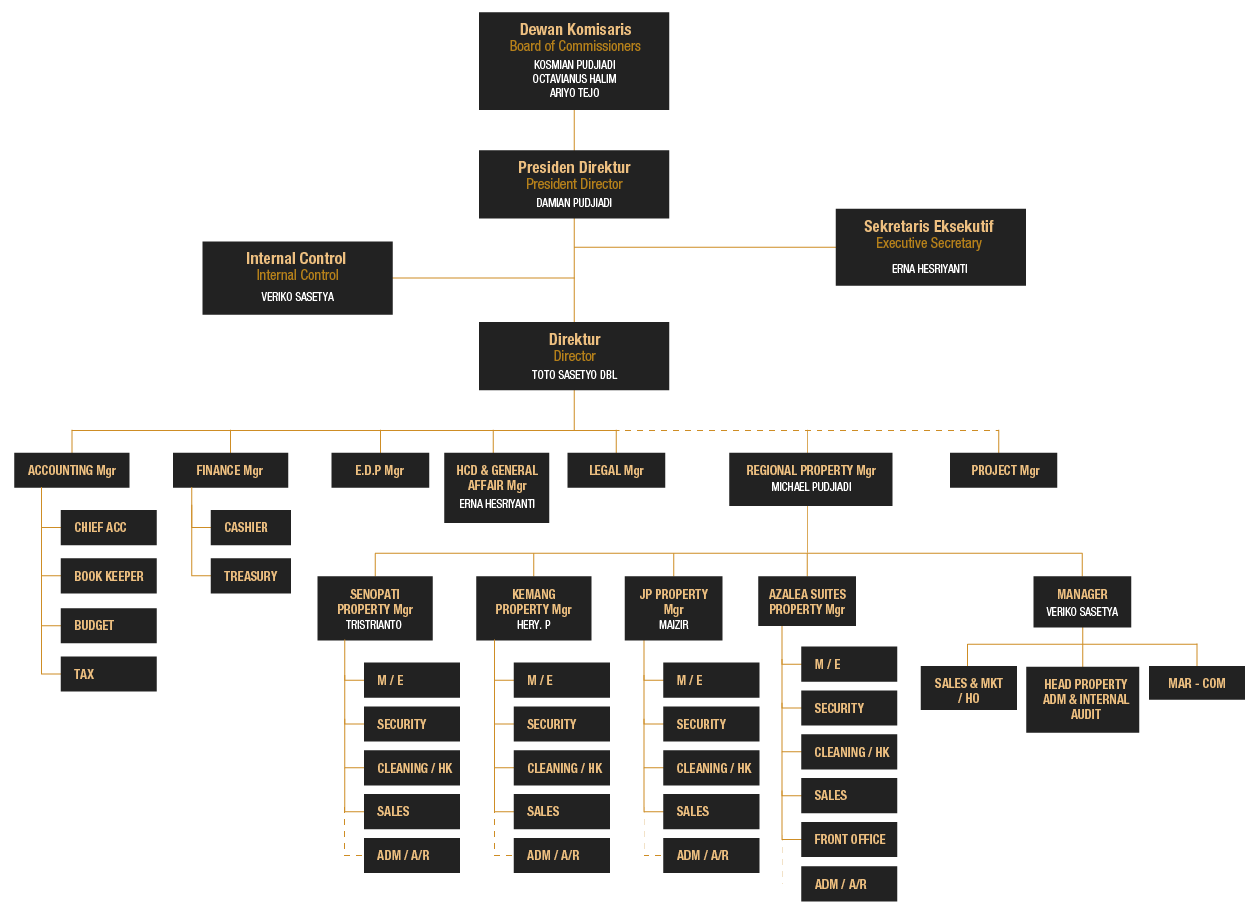

Organization Structure

Human Resource

The Company firmly believes that Human Resources is a key asset in all of its business activities. The important elements of continuity, success and quality depend largely upon the knowledge and skill of each employee. Hence, The Company endeavors to create an effective and competitive organization by building the capacity of its human resources because The Company believes that with a high work ethic and a favorable working environment contributes significantly to the Company’s Advancement and future success.

As a valuable assets within the Company, employees must uphold the 7 Corporate Core Value which are: Honesty, Discipline, Transparency, Commitment, Consistent, Creative & Innovative, Diligent & Tenacious, as well as, the ability to adapt to an ever changing business world.

The Company implemented a HR management strategy on an ongoing basis, systematic and always focused on creating a professional HR. So in the end the entire HR can play an active role in supporting the growth of the Company’s business in the future.

Employee Composition

The Company and its subsidiaries are supported by competent employees in each field.

Until the end of 2017, composition of employees of the Company and its subsidiaries comprises 507 persons.

Based on educational level, employees composition of the Company consists of post (graduate) 11.24% from the total employees, Diploma 12.62%, and Non Academic 76.14%.

Employees Composition Based on Educational Level :

Meanwhile, the composition of the Company’s employees based on the post consist of the Board of Directors (0.39%), Managers (10.45%), Assistant to Managers (4.14%), Supervisor (9.66%), and Staff (75.36%), with a composition ratio in 2017 and 2016 as follows :

.png)

Employess Composition Based on Title (not including the Board of Commissioners)

In terms of age groups, the composition of the Company’s employees is the age group < 25 years (7.50%), the age groups between 26 years – 30 years (13.81%), the age groups between 31 years – 40 years (42.01%) and the age groups > 40 years (36.68%).

Comparison of the composition of employees in 2017 and 2016 by the age groups is described as follows :

Recruitment

In order to obtain the appropriate personnel and in accordance with the Company’s needs, the Company implemented a system of recruitment as follows : through print ads and online (JObsDB and JobStreet).

Employee Development

The Company pays serious attention to the enhancement of personnel competency both in main functions and supporting organs. The Company places priority on human resources development by laying down clear paths for employees in each business unit and across the organization, nurturing a corporate culture that emphasizes mutual reinforcement and mutual cooperation, shaping the Company into becoming an organization with impressive business performance.

Throughout the year 2017, the Company has conducted a variety of training to improve employee’s competencies, character building and togetherness among the staffs, consisting of :

1. Job rotation and transfer of employees;

2. Training on technical skills for the employees;

3. External training (public training) for the manager up levels

Employee Assessment

Employee Assessment is measured using Key Performance Indicator that regulates every position periodically every 6 (six) months. This assessment will impact to the promotion and compensation received by the employees. This assessment is also used to notice the weakness within every position, so it can be improved and contribute a maximum results in the future.

Employee’s Welfare

Enhancing employee’s welfare is also become the Company’s priority as a part of an effort to keep and improve quality and employee’s morale. With a prosperous employees, the work ethic owned will be increased so that helps sustain Company’s performance in achieving the targets set. The Company always makes an effort to improve it by giving compensation and various proper allowances for the employees includes salary paid to employees in accordance with the provisions of the Provincial Minimum Wage (UMP), marketing incentive for any achievement of sales, and also bonuses for the profit gains by the Company. The Company’s also included all employees in guarantees social workers (Social Security) including death insurance program, accident program, and old age insurance through BPJS Ketenagakerjaan and also health insurance program including inpatient and outpatient program through BPJS Kesehatan.

As a form of long term commitment, the Company keep trying to improve the employee’s welfare by founding an organization for employees. The Company keep helping to improvise so that the organization can optimally give benefits to the employees. Until today, the organization has been providing loan and saving services for the employees.

Good Corporate Governance

INTRODUCTION

The Company is fully aware of the importance of Good Corporate Governance practice of which its implementation is continuously developed. The Company is committed to implement the basic principles of Good Corporate Governance i.e. Accountability, Responsibility and Transparency in carrying out all activities in the Company in order to improve the performance of the Company.

To be well implemented, the corporate governance requires good cooperation and relationship between the Company’s management and supervision functions, which include Board of Commissioners, Board of Directors, Audit Committee, Corporate Secretary and Internal Audit.

The Company understands the importance of good corporate governance. A Company with good corporate governance has transparent operations which simplifies the execution or implementation of new strategies and mitigates risks of fraud and misleading accounts reporting.

Good Corporate Governance is also applied in compliance with law, UU RI No. 40 Year 2007 re Perseroan Terbatas, regulatory bodies (Indonesia Stock Exchange/ IDX and Capital Market Supervisory Board and Financial Institutions/Bapepam & LK).

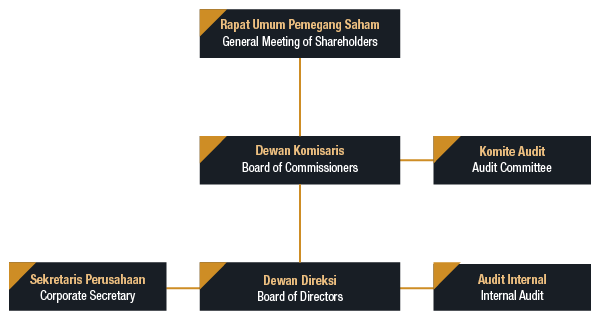

Corporate Governance Structure

Structure of the Company’s Corporate Governance consists of Shareholders, the Board of Commissioners, the Board of Directors, Corporate Secretary and the supporting organs that include Audit Committee and Internal Audit.

Corporate Governance Structure

Shareholders

Shareholders are the Company’s instrument that have the authority to make decision related to the Company’s policy as well as assess Board of Commissioners and Board of Directors through the General Meeting of Shareholders (GMS).

General Meeting of Shareholders

General Meeting of Shareholders serves as Shareholder’s platform in making decision regarding to the Company’s policy.

Pursuant to the Articles of Associations, the Company has to hold General Meeting of Shareholders at least once in a year and can hold Extraordinary General Meeting of Shareholders any time it is needed. As the highest body in the Company, General Meeting of Shareholders is held to approve the strategic policies and other material and specific issues which can’t be decided by Board of Commissioners and Board of Directors.

In 2017, the Company held General Meeting of Shareholders on June 9th , 2017 at Jayakarta Hotel 12th Floor, Jl. Hayam Wuruk Nol 126 which was attended by shareholders with 253.888.122 shares ownership or equal to 77.04%

The General Meeting of Shareholders had the following agenda as follows :

1. To approve and ratify the Company’s Annual Report comprises of the Company’s activities Report of the Company’s Board of Directors and the supervisory report of the Company’s Board of Commissioners for the year ended on December 31st, 2016;

2. To approve and ratify the Company’s Financial Statement including Balance Sheet and Profit/Loss statement for the year ended on December 31st, 2016;

3. The use of the Company’s Net Profit for the year ended on December 31st, 2016.

4. The Appointment of the Company’s independent public accountant which will audit the Company’s reports for the year ended December 31, 2017;

5. The Dismissal of all members of the Board of Directors and Board of Commissioners the dismissal of all members of the Board of Directors and the Board of Commissioners of the Company in connection with the expiration of their period of office, and the appointment of new members of the Board of Directors and Board of Commissioners in accordance with the provisions in the Articles of Association of the Company In 2017, the Company held Extraordinary General Meeting of Shareholders on June 9th , 2017 at Jayakarta Hotel 12th Floor, Jl. Hayam Wuruk Nol 126 which was attended by shareholders with 253.888.122 shares ownership or equal to 77.04% with the agenda of adding provisions in the company's articles of association in Article 3 on the purpose and objectives and business activities.

The Board of Commissioners

Pursuant to the Company’s Article of Associations, the Board of Commissioners and Directors were appointed by Annual General Meeting of Shareholders for 3 (three) years and may be reappointed.

Recently, the Company assigned 3 (three) Commissioners, 1 (one) of whom is Independent Commissioner. As of December 31st, 2017, the composition of the Company’s Board of Commissioners as follows :

President Commissioner : Kosmian Pudjiadi BSISE,MBA

Commissioner : Ariyo Tejo

Independent Commissioner : Octavianus Halim, MBA

Board of Commissioner’s Functions and Duties

Board of Commissioners holds an essential role in the implementation of the Company’s Good Corporate Governance. The Board of Commissioners is responsible for monitoring Board of Director’s policy and performance, providing inputs and directions regarding the material issues to Board of Directors. Details of Board of Commissioners function and duty in relation to the implementation of the Company’s Good Corporate Governance as follows :

1. To oversee Directors policies and performance in carrying out its business plan;

2. To promote implementation of a good corporate governance in the company environment.

3. To conduct supervisory and assessment to the Board of Director’s management;

4. To oversee the Committees under the Board of Commissioners;

5. To provide advice to the Board of Directors related to the policy in managing the Company, including planning, development, operations and budget of the Company.

6. To conduct annual GMS and other GMS in accordance with its authorities as referred to in the regulations and articles of associations.

The Board of Commissioners Charter

As the organ that oversees and advises the Board of Directors, the Board refers to Employment Guidelines for the Board of Commissioners and Board of Directors which provides instructions on how to practice and the Board of Commissioners and Board of Directors as well as the passess of activities in a structured, systematic, easy to understand and can be run consistently, it can be a reference for the BOC and BOD in carrying of their respective duties to achieve the Company’s Vision and Mission.

Board Charter made reference to the regulatory authority financial services number 33/POJK.04/2014 of the Board of Directors and the Board of Commissioners of Public Listed Company and include :

1. Definition

2. Legal basis, mission and purpose

3. Appointment, dismissal of the Board of Commissioners, requirements

4. Duties, Powers and responsibilities of BOC

5. Orientation and Training for BOC

6. Validity and compliance Frequency of the Board of Commissioners Meeting and attendance level.

Independent Commissioners

Independent Commissioner is a member of BOC who does not have financial relationship, management relationship, share ownership and/or family relationship with other member of BOC, the BOD and/or controlling shareholders which may affect its ability to act independently and fullfils requirements as Independent Commissioner pursuant to the GCG principles Appointment of Independent Commissioner arranged in Financial Service Authority Regulator No. 33/POJK.04/2014 about Directors and Board of Commisioners of the Issuer of Public Company or Regulation of the Indonesia Stock Exchange in Bapepam Regulation No. IX.I.5 and the Indonesia Stock Exchange No. 1A Kep-305/BEJ/07-2004. Independent Commissioner is responsible for overseeing and also represents their interests of minority shreholders.

The Board of Directors

The Board of Directors is the Company’s organ which is responsible for managing the Company and to achieve the Company’s vison pursuant to the Company’s Articles of Association. The Board of Directors also ensures the sustainability of the Company’s business, the Company’s achievement according to the business target and management of prudence principles in the implementation of the Company’s policies.

As of December 31st, 2017, The Company’s Board of Directors comprises of :

President Director : Damian Pudjiadi, MBA

Director : Toto Sasetyo Dwi Budi L.

The Board of Directors Function and Duties

The Board of Directors hold the responsibility to manage and organize the Company and has the authority in the decision making process. In managing the Company, duties and responsibilities of the Board of Directors are comprised as follows :

1. To run and lead the Company in accordance with the goals, vision and mission as well as business plans and strategies that have been set;

2. To control, maintain and manage the Company’s assets;

3. Actively coordinate and cooperate within the organization and communicate the implementation of the Company’s strategy in order to ensure that the action taken is similar with the Company’s aim;

4. To encourage the implementation of the Good Corporate Governance consistently;

5. To provide all information related to the Company to the Board of Commissioners if necessary;

6. To prepare the Company’s Annual Report;

7. Pursuant to the articles of associations, the Board of Directors is obliged to present the Company’s Work Plan and Annual Budget to the Board of Commissioners.

The Board of Directors Charter

Considering its significant role to manage the Company, Directors require a Working Guidelines (Charter) as a guidance for the Board of Directors in carrying out their duties and responsibilities. Board Charter provides instructions on how to practice and the Board of Commissioners and Board of Directors as well as the passess of activities in a structured, systematic, easy to understand and can be run consistently, it can be a reference for the BOC and BOD in carrying of their respective duties to achieve the Company’s Vision and Mission.

Board Charter made reference to the regulatory authority financial services number 33/POJK.04/2014 of the Board of Directors and the Board of Commissioners of Public Listed Company and include :

1. Definition

2. Legal basis, mission and purpose

3. Appointment, dismissal of the Board of Commissioners, requirements

4. Duties, Powers and responsibilities of BOC

5. Orientation and Training for BOC

6. Validity and compliance

Program of Competence Development for the Board of Directors and the Board of Commissioners In order to enhance the Board of Director and the Board of Commissioner’s ability, throughout 2017, they are participated in various trainings, workshops and seminars.

Determination and procedure of remuneration of the Board of Commissioners and the Board of Directors

Remuneration of the Board of Commissioners and the Board of Directors is determined once a year through General Meeting of Shareholders. Each member of the Board of Commissioners and the Board of Directors receives monthly honorarium, allowances and other facilities.

During 2017, the Company issued approximately Rp. 975 million for the remuneration of the Board of Commissioners and Rp. 3.5 billion for the Board of Directors.

Audit Committee

Pursuant to Regulation of Supervisory Board for Capital Market and Financial Institutions (Bapepam-LK) regarding the Audit Commitee, The Company is responsible to form the Audit Commitee. The Audit committee is responsible for providing inputs to Board of Commissioners towards reports andn information form the Board of Directors and others related to its duties.

Audit Committee provides professional and independent advices as well as analysis to Board of Commissioners toward the operational and financial performance achieved by Directors. Audit Committee is assisting by Internal Audit that held routine audits toward the management performance.

Pursuant to the Audit Committee Charter, Audit Committee is responsible in

1. released financial information, including financial statements, projections and other information;

2. compliance with Capital Market and other regulations related to the operations;

3. business plans and audit result from internal audit and the effectively of internal control;

4. the sufficiency of audit process by external auditor and giving recommendation in appointing the public accountant;

5. business risks and risk management;

6. complaints relating to the accounting and financial reporting processes of the Company to the Board of Commissioners;

7. provide advice to the Board of Directors relating to the potential conflict of interest in the Company;

The audit Committee has the responsibility to maintain confidentiality of documents, data and information of the Company as well as to create, review and update the Audit Committee Charter Audit Committee is appointed by the Board of Commissioners and led by the Independent Commissioner. Currently, Audit Committee has 3 (three) members, including the Chairman.

Profile of Audit Committee Members

Octavianus Halim, MBA (Chairman)

Obtained his MBA degree from Northrop University, Los Angeles, and has been appointed as the Company’s Chairman of Audit Committee since 2014 until now.

Lusi Wardani (Member)

Earned a Diploma in Accounting from the Academy of Finance & Accounting Wika Jasa , and has been appointed as the Company’s Audit Committee since 2018 until now.

Dadang Suwarsa (Member)

Born at Kuningan, April 23, 1965, and earned his Bachelor Degree in Accounting from Pasundan University, Bandung. He has been appointed as a member of the Audit Committee since 2001 until now.

Report of Working Implementation of Audit Committee for the year ended 2017

The Audit Committee during 2017 had reviewed the Company’s Quarterly Financial Statements and discussed it with the Company’s Management. The Audit Committee has also participated in reviewing the Company’s Annual Budget.

The Audit Committee also had held routine meetings with the Internal Audit of the Company to discuss its findings in order to enhance the internal control.

Besides, The Audit Committee also had held meetings with the External Auditor and Company’s Management to discuss the audited Company’s Financial Statements for the year ended December 31st, 2017 and also recommends to the Board of Commissioners that the audited Company’s Financial Statements for the year ended December 31st, 2017 could be accepted and reported in the Company’s Annual Report.

Other Committees Under the Board of Commissioners

Until the end of 2017, the Company has no other Committees under the Board of Commissioners.

Corporate Secretary

As the implementation of good corporate governance, the Company has formed Coporate Secretary who is responsible for justifying the data, information and needs between the stakeholders and the Company.

Pursuant to Bapepam and LK regulations, the Company appointed Corporate Secretary with the main roles as follows :

1. To update with Capital Market information, including but not limited to the regulations applied;

2. To announce public disclosures related to every transaction or event that has material impact to the Company

3. To ascertain that the Company has complied with Bapepam & LK and IDX regulations;

4. As the contact person of the Company in dealing with Bapepam & LK, IDX and public;

Currently the Corporate Secretary of the Company is served by Mr. Adwien Dhanu Suhendro who has been the Corporate Secretary since 2000.

Profile of Corporate Secretary

Earned Certified Hotel Administrator from Intercontinental Hotels advanced education program, MBA from IPWI Institute and undergraduate in Hotel Management from Trisakti Hotel & Tourism University. 40 years long and viable track in Hospitality Industry comprises 22 years in Hotel Operations, Regional and Administration, started in Hilton and mainly in Intercontinental Hotels Worldwide and 18 years in Corporate Level.

Internal Audit

The Internal Audit Department is established to assist the Board of Commissioners and Board of Directors in supervising and securing the Company’s investment value and wealth;

The Internal Audit works independently to evaluate the internal control system as well as the compliance level toward the system, applied procedures and policies and also to give recommendations for necessary improvements. The existing internal control system will be periodically reviewed by the Internal Audit and Management to be able to discover whether it still effective in coping the appeared risks.

Internal Audit Charter issued by the Company consists of scope of work, structure and position, task and responsibilities, code of conduct and liability.

The Internal Audit’s tasks and responsibilities The Company’s Internal Audit tasks and responsibilities are as follow :

1. To organize and held Annual Internal Audit Plan;

2. To examine and evaluate the implementation of internal control and risk management system according to Company Policy;

3. To check and give assessment on financial accountancy, operational, human resources, marketing, information technology and other activities effectiveness and efficiency;

4. To give restoration advice and objective information about examined activities in all management level;

5. To prepare audited report to President Director and Board of Commissioners;

6. To monitor, analyze and report the realization of the restoration advices;

7. To work together with the Audit Committee to arrange programs and evaluate the quality of intenal audit activities;

8. To arrange special examination, if necessary;

The Company’s Internal Audit Members and the profile Pursuant to Bapepam regulations No.: Kep-496/BL/2008, the Company through the President Director has appointed the Internal Audit Members with the approval of the Board of Commissioners. The Company’s Internal Audit Members is as follows :

Ardika May Fendra (Member)

Born in Solok, May 28th 1978 and earned his bachelor degree in Accounting from Andalas University in 2003. He has been appointed as a Member of Internal Audit Division since March 1, 2010 until now.

Lanang Prabowo, SE (Member)

Born in Jakarta, January 4th, 1988 and obtained his bachelor degree in Accounting from STIE YAI in 2010. Appointed as a Member of Internal Audit Division since October 1st, 2015 until now.

Internal Control System

Internal Control System is part of the Company’s efforts to achieve good corporate governance of the Company.

The Internal Audit Division will examine and evaluate the Company’s internal control and will be poured in Internal Audit Report which will be submitted to the President Director and the Board of Commissioners completed with the recommendations and suggestions needed.

Risk Managment System

In running the business, the Company is fully aware that it may face various risks which can slow down the goal achievement as well as significantly affect the operations, revenues and assets.

The risks are as follows :

Land Limitation Risk :

The company plans to expand its business by acquiring land in high growth area. However, the availability of land in those areas is very limited and the failure in acquiring the land will bring negative impacts to the business expansion plan could affect the financial condition and revenue of the Company.

Legal Assurance Risk :

The absence of law enforcement to assure Indonesia’s land regulation as well as the irregularity of Indonesia’s land entitlement, can cause the possibility of dispute between the Company and the previous owner regarding the land entitlement. Besides, the difficulty of bureaucratic procedure for permit issues also can cause the obstacle of the development of the property which at the end will affect the financial condition of the Company.

Property Market Fluctuation Risk :

Indonesia’s property industry has a cycle and significant affected by general or local economic condition changes, such as government policy, unemployment rate, funding availability, increase of oil and gas, raw materials and basic good that causes increase of production costs in real estate that practically causes the higher price of the products, interest rate, consumer trust and property product demand. Pressures in Indonesia property industry may affect business, financial condition and the Company’s operational result.

Competition Risk :

Every business has to compete including property business. The developers shall compete in matters of location, facilities, supporting infrastructure, service and price. The tight competition among the developers, may increase cost for land acquisition, excessive land stock and slow process to obtain permission to develop new properties from governmental institution may bring bad impacts for the Company’s business and performance.

Interest Rate Risk :

The Company’s interest rate risk mainly arises from loan to working capital and investment purposes. Loans at variable rates expose the Company fo fair value interest rate risk.

For working capital and investment loans, the Company may seek to mitigate its interest rate by continuously monitoring the interest rates in the market.

Credit Risk :

The Company is exposed to credit risk arising from the credit granted to its customer and deposits being placed in banks. To mitigate this risk, the Company has policies in place to ensure that sales of products are made only to creditwhorty customers with proven track record or good credit history. It is the Company’s policy that all customers who wish to trade on credit are subject to credit verification procedures. In addition, receivable balances are monitored on an ongoing basis to reduce the exposure to bad debts.

When a customer fails to make payment within the credit term granted, the Company contacts the customer to act on the overdue receivables. If the customer does not settle the overdue receivable within a reasonable time, the Company proceeds to commence legal proceedings. Depending on the Company’s assessment, specific provisions may be made if the debt is deemed uncollectible. To mitigate credit risk, the Company ceases the supply of all products to the customer in the event of late payment and/or default.

To mitigate the default risk of banks on the Company’s deposits, the Company has policies to place its deposits only in banks with good reputation.

Liquidity Risk :

The Company manages its liquidity profile to be able to finance its capital expenditure and service its maturing debts by maintaining sufficient cash and cash equivalents, and the availability of funding through an adequate amount of commited credit facilities.

The Company regularly evaluates its projected and actual cash flow information and continuously maintains its payables and receivable days.

Other Risks :

The Company’s business activities may also influenced by economic situation, social politic conditions, natural disasters, terrorism, fire and other risks. The Company has carried out various steps to minimize the risks such as maintaining the quality of the developing properties, to insure the primary assets of the Company, and looking for potential land for new developments.

Legal Case Faced by The Company, Subsidiaries, Member of Board of Directors and/or Member of board of commissioners in 2017 Througout 2017, the Company did not encounter legal cases both civiland and criminal. code of conduct & corporate core value of the company

7 corporate core value of the Company consists of:

• Honesty

• Dicipline

• Transparant

• Commitment

• Consistent

• Creative & Innovative

• Diligent & Perservering

Code of conduct is a guidline that covers values and standards of business practice adopted by the Company and become a guidline for each individual in the Company and at the same time describe all parties how the Company runs it business All articles and rules stated in the Code of Conduct are applied to all individual with no exception. The Company will give punishment to all employee and all members of management who break the rules according to the Company’s rules and regulations.

Whistleblowing System

Currently the Company has no whistleblowing system, however in case of violation of the code of conduct, the Company will handle the violator according to the Company’s regulation which contain how to submit the report in detail, the protection for the whistleblower, how to handle the report, those who manage the complaint and the result of handling the complaint.

Information Access

The Company has website that includes important information about the Company and can be accessed by public through www. pudjiadiprestige.com. Investors and public can also gain further details of the Company through the Company’s email address: info@pudjiadiprestige.com.